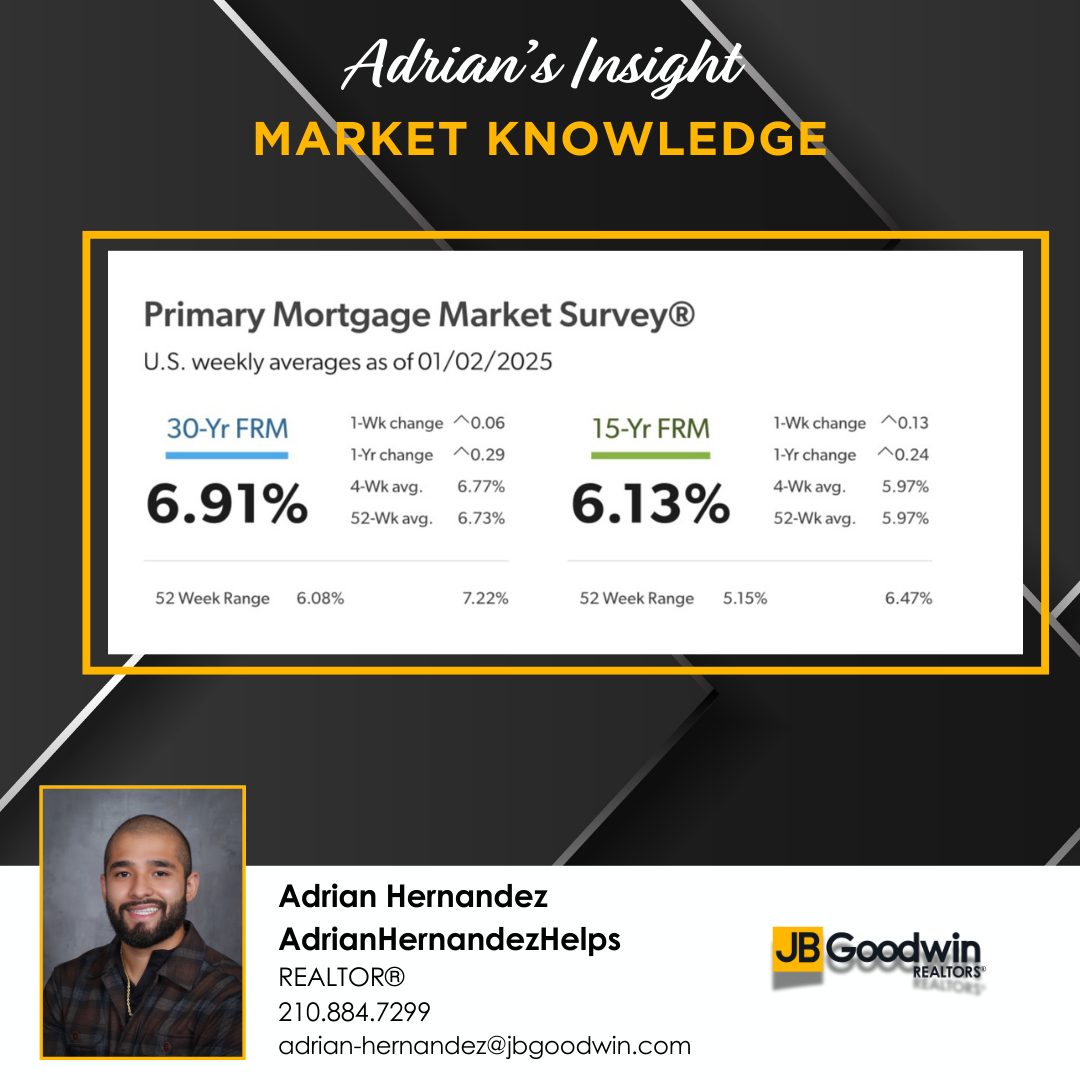

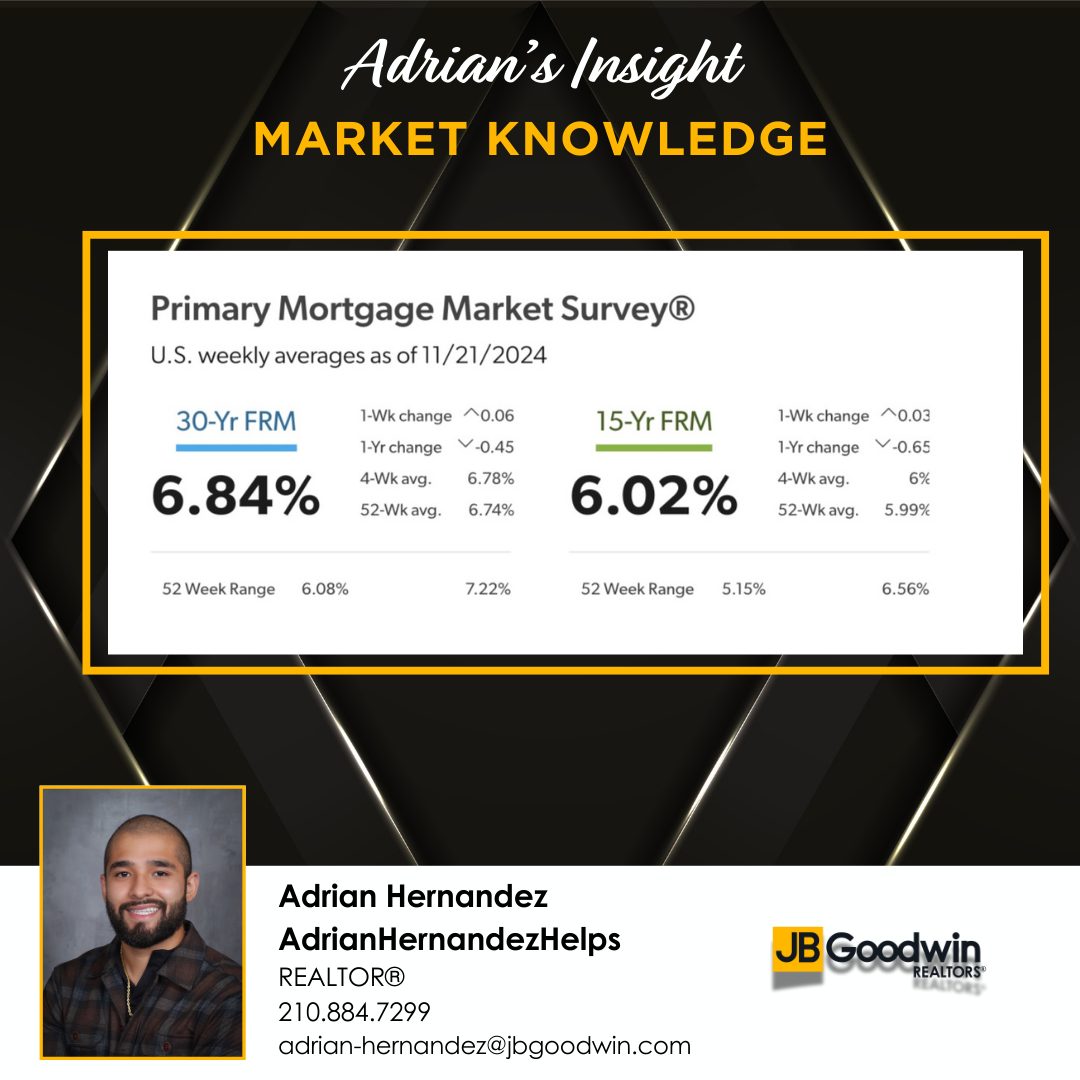

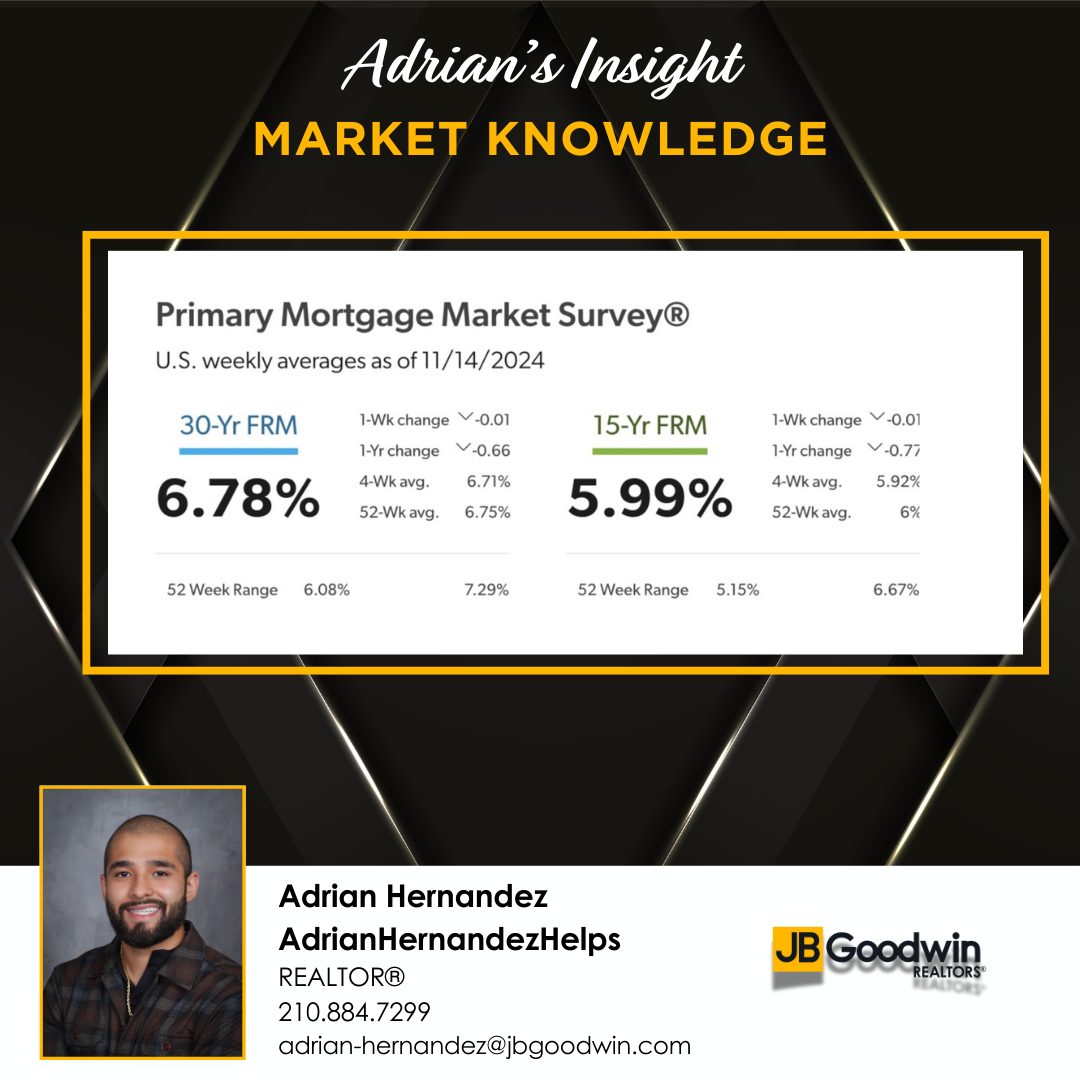

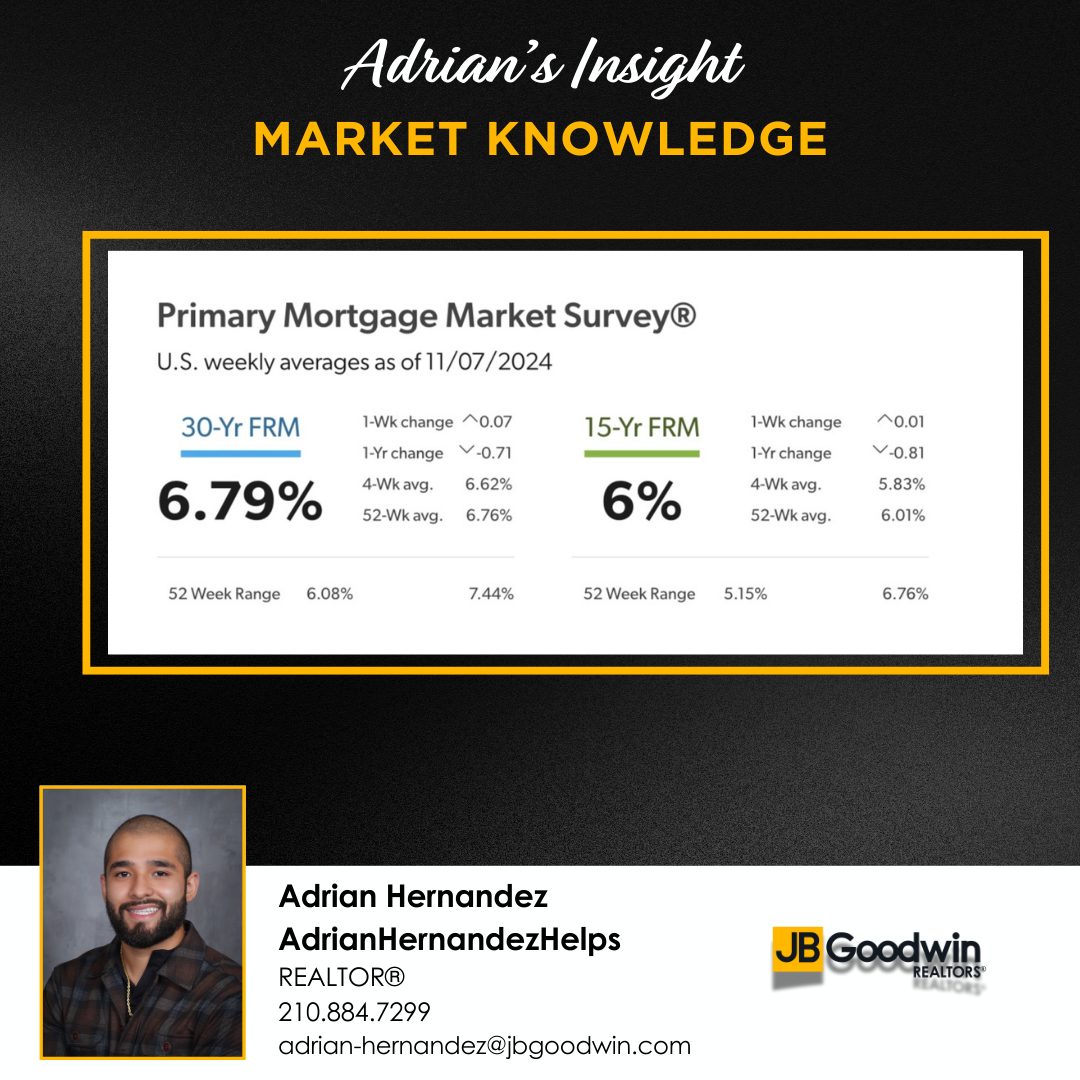

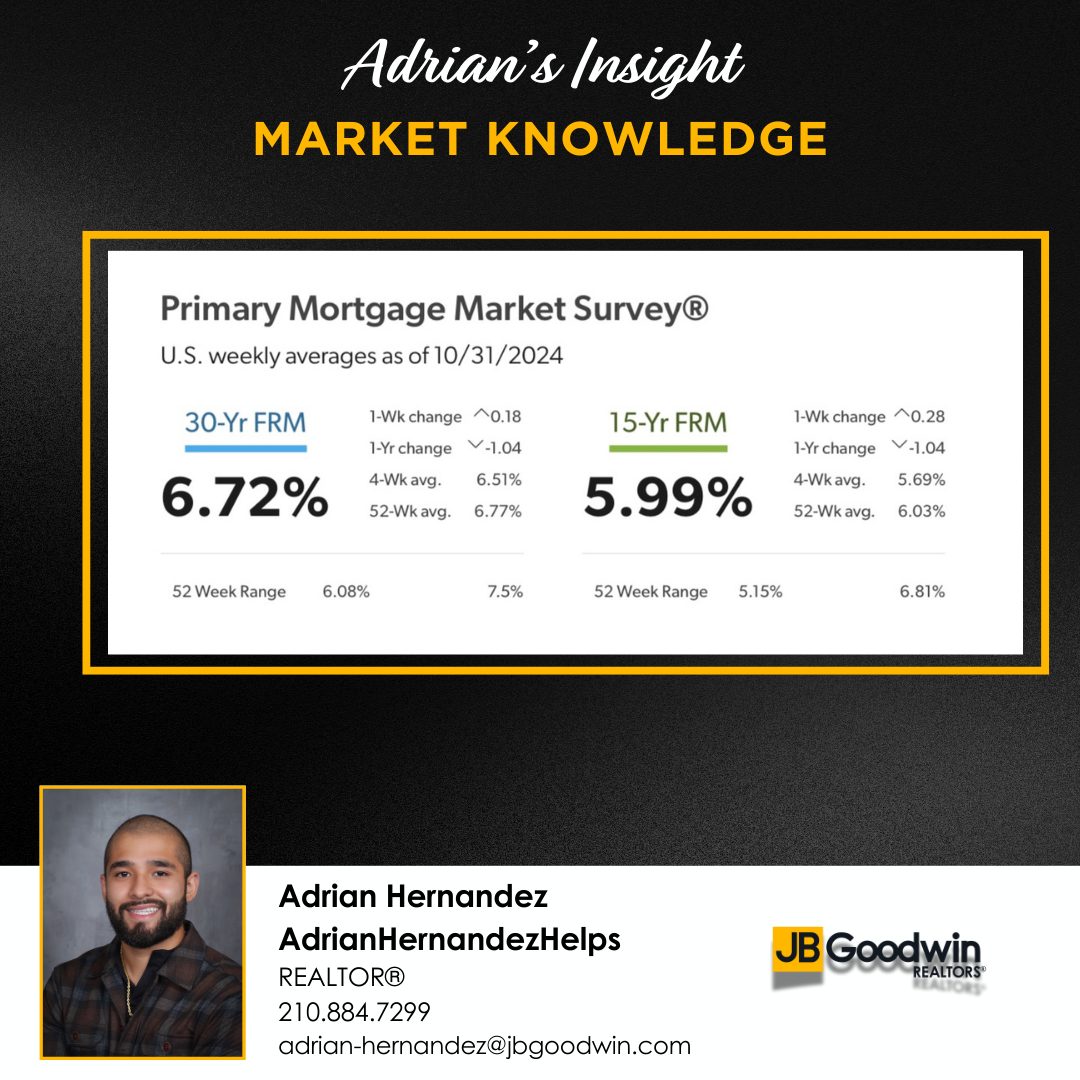

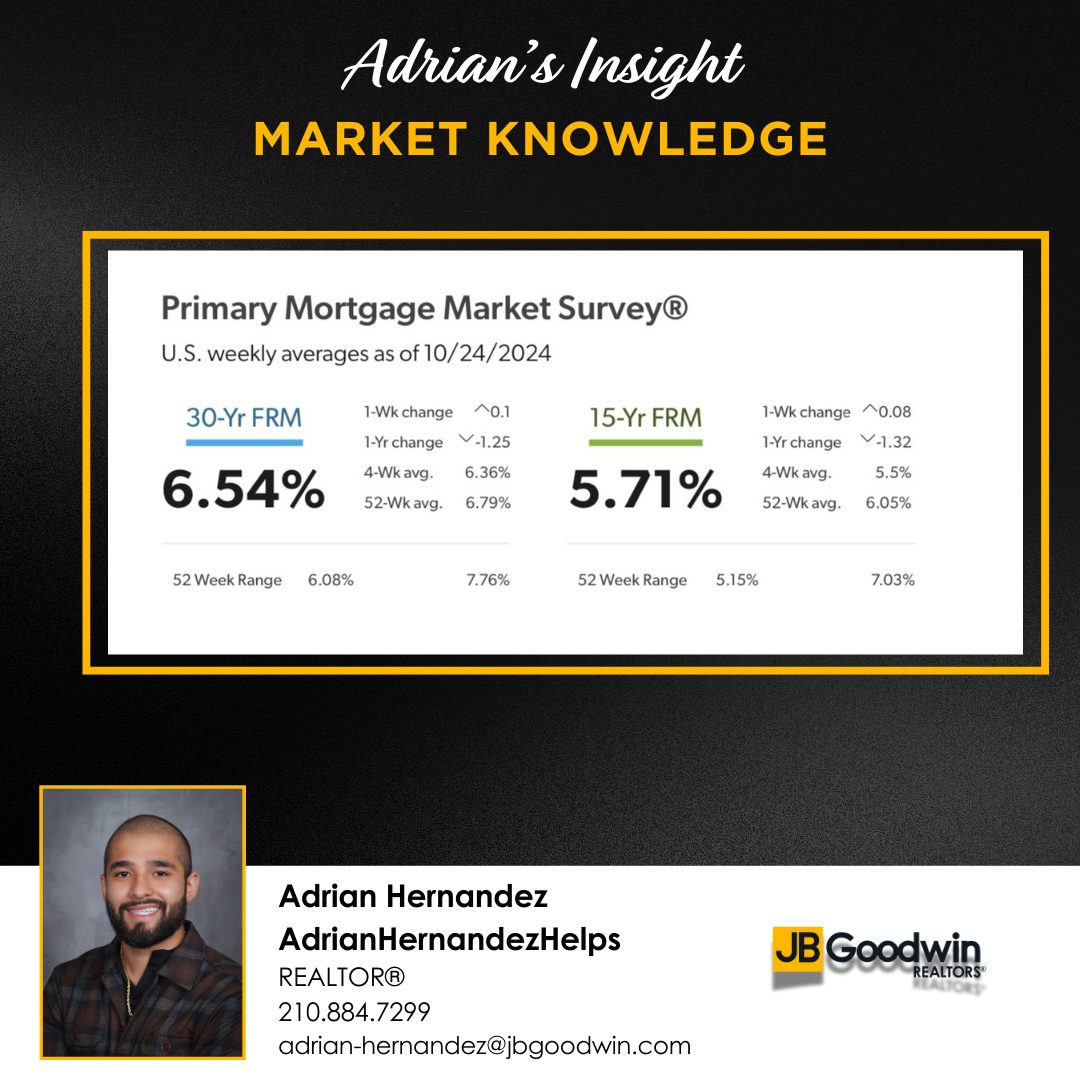

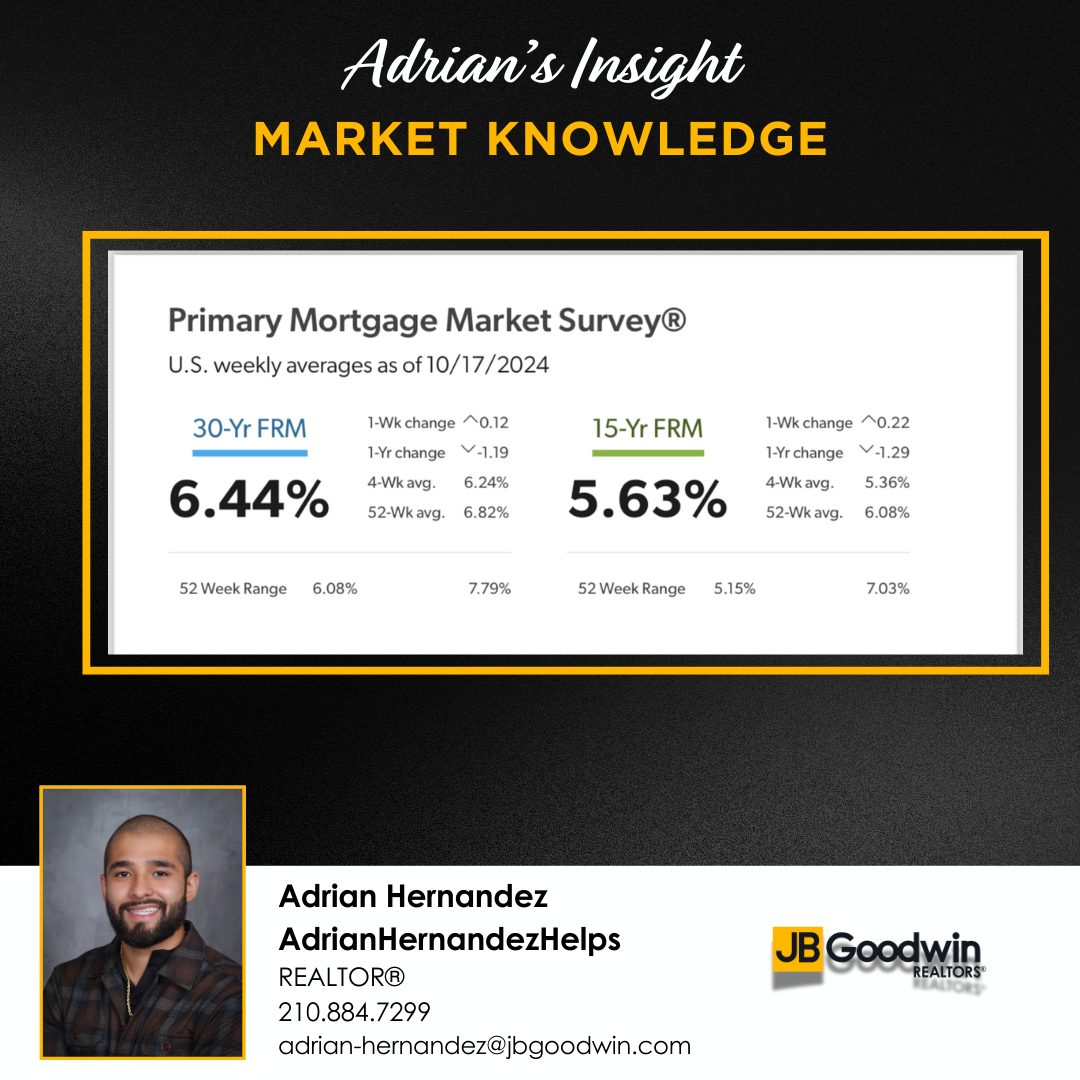

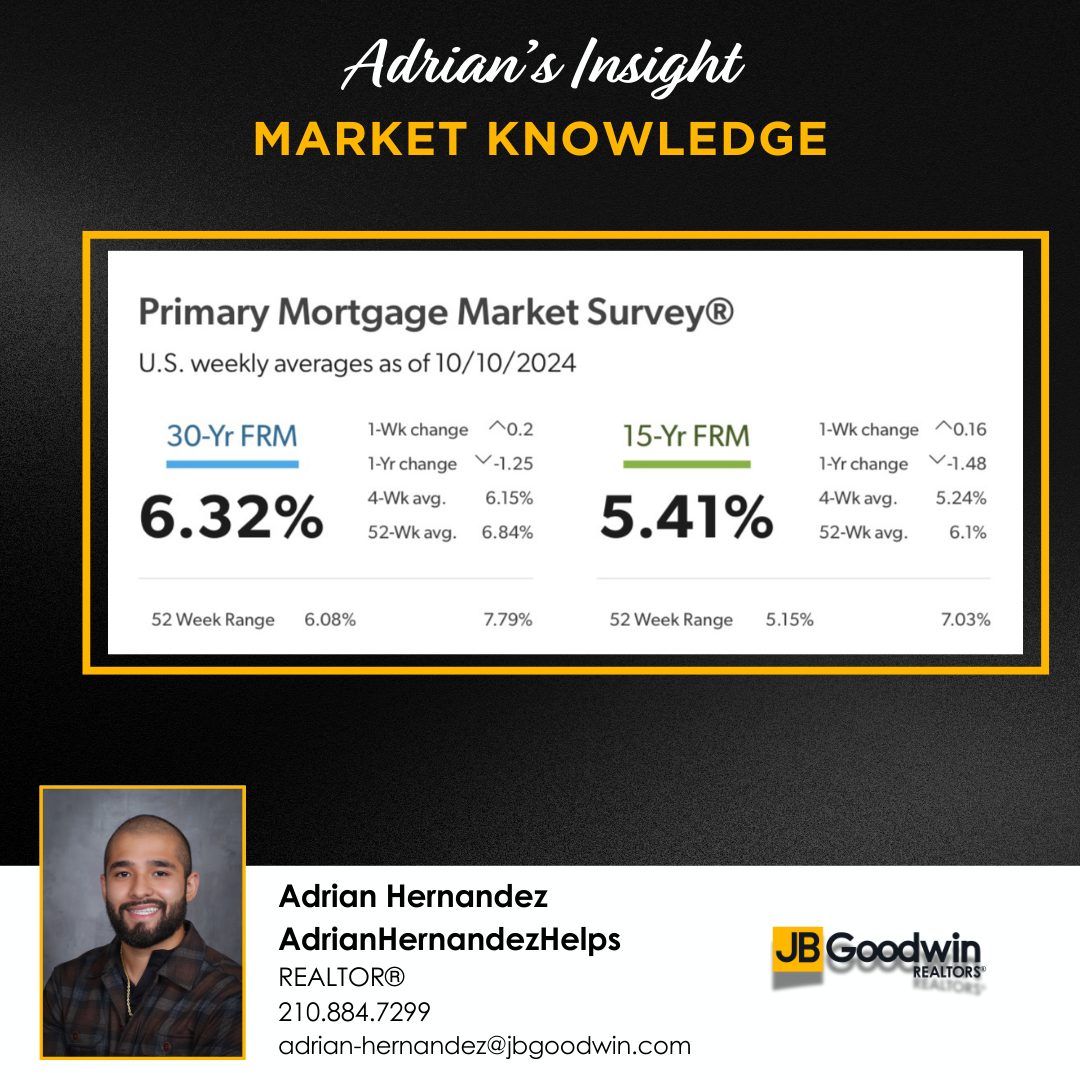

Happy New Year, everyone! I hope your holiday season was filled with loving memories. As rates continue to remain volatile and shift upwards, buyers should stay educated on changing rates to explore their unique possibilities. Since everyone is different, it is important to stay responsible and compare this information to your personal situation to make decisions in your best interest.

AdrianHernandezHelps-JBGoodwin REALTORS®

📞(210)884-7299

📧adrian-hernandez@jbgoodwin.com

Have an awesome day!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link