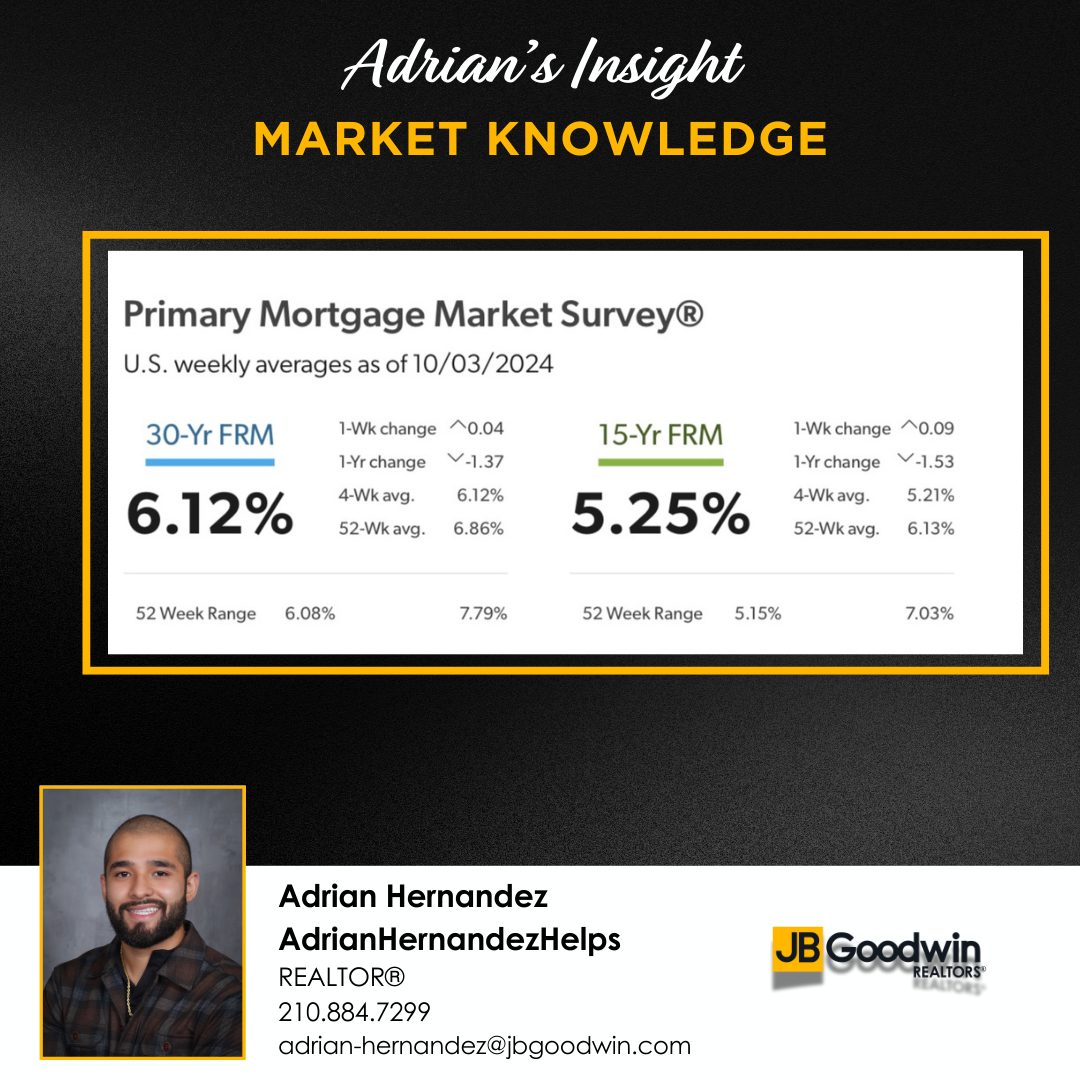

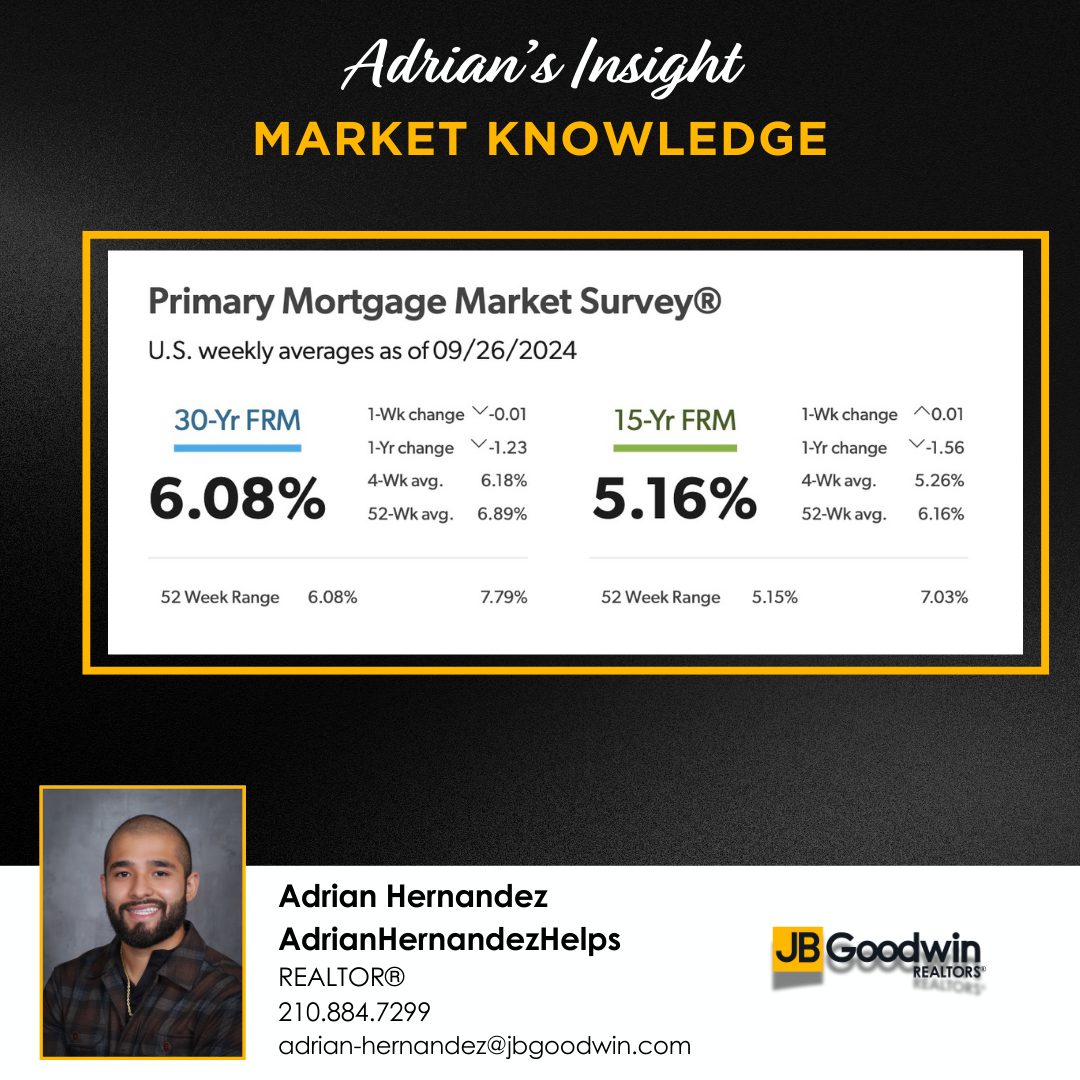

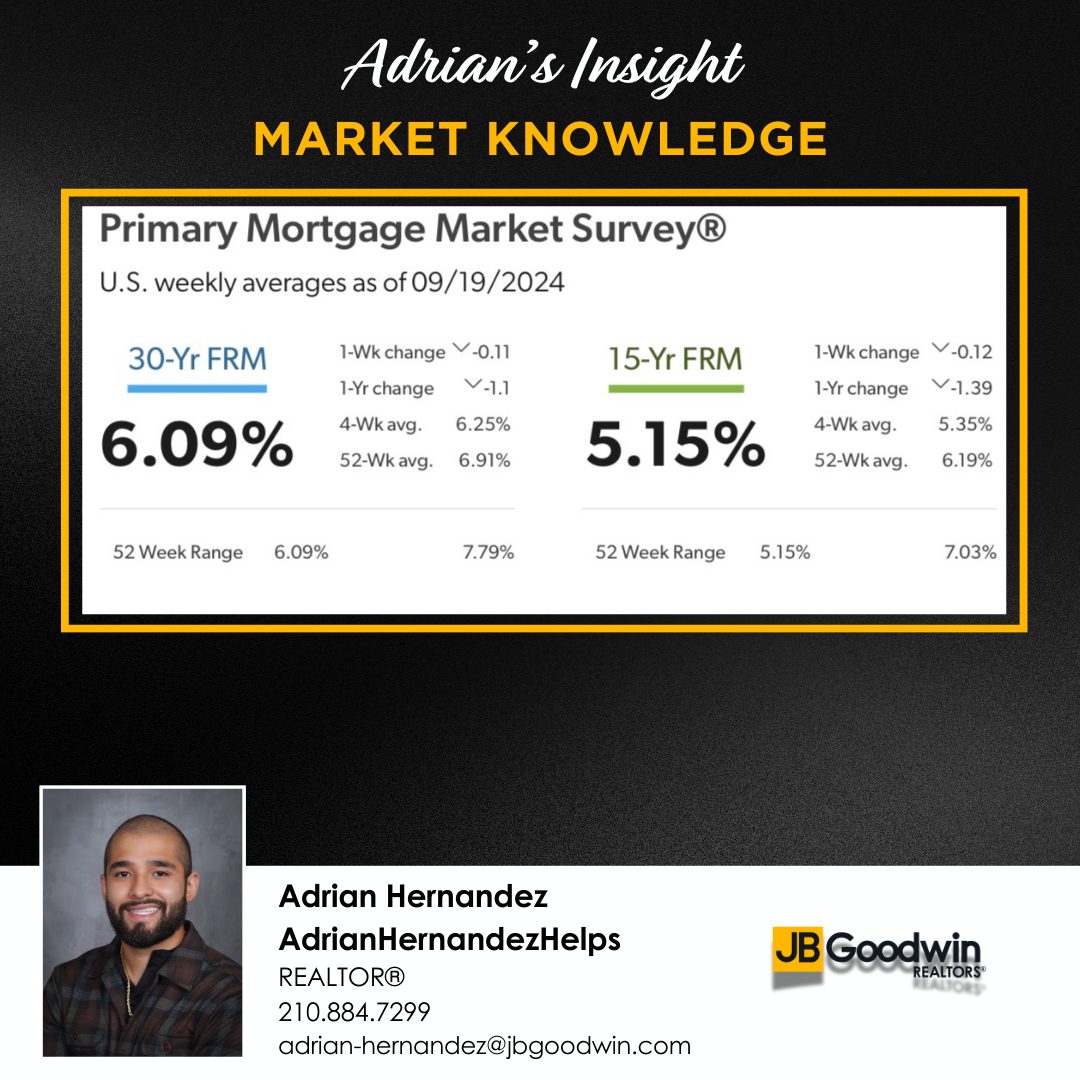

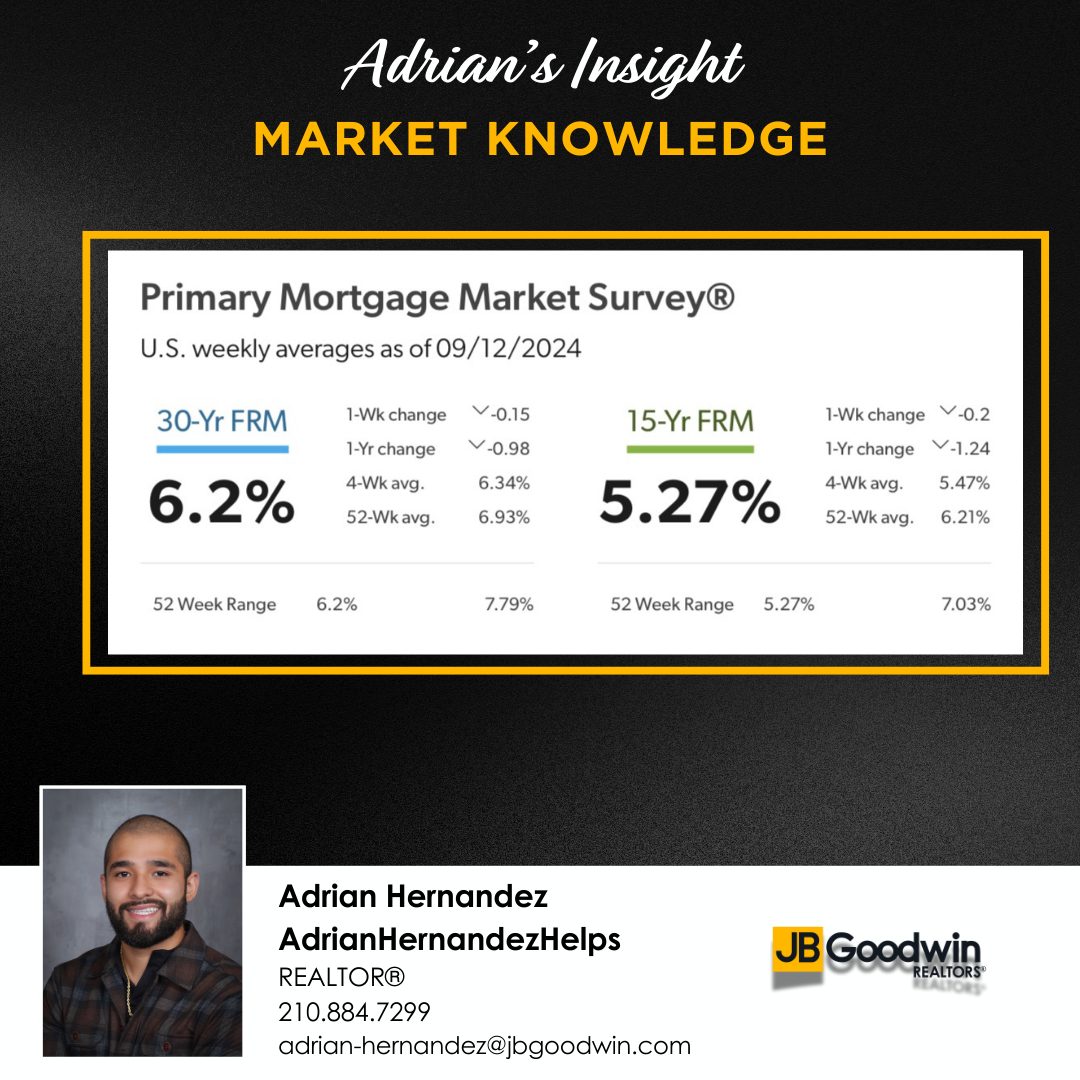

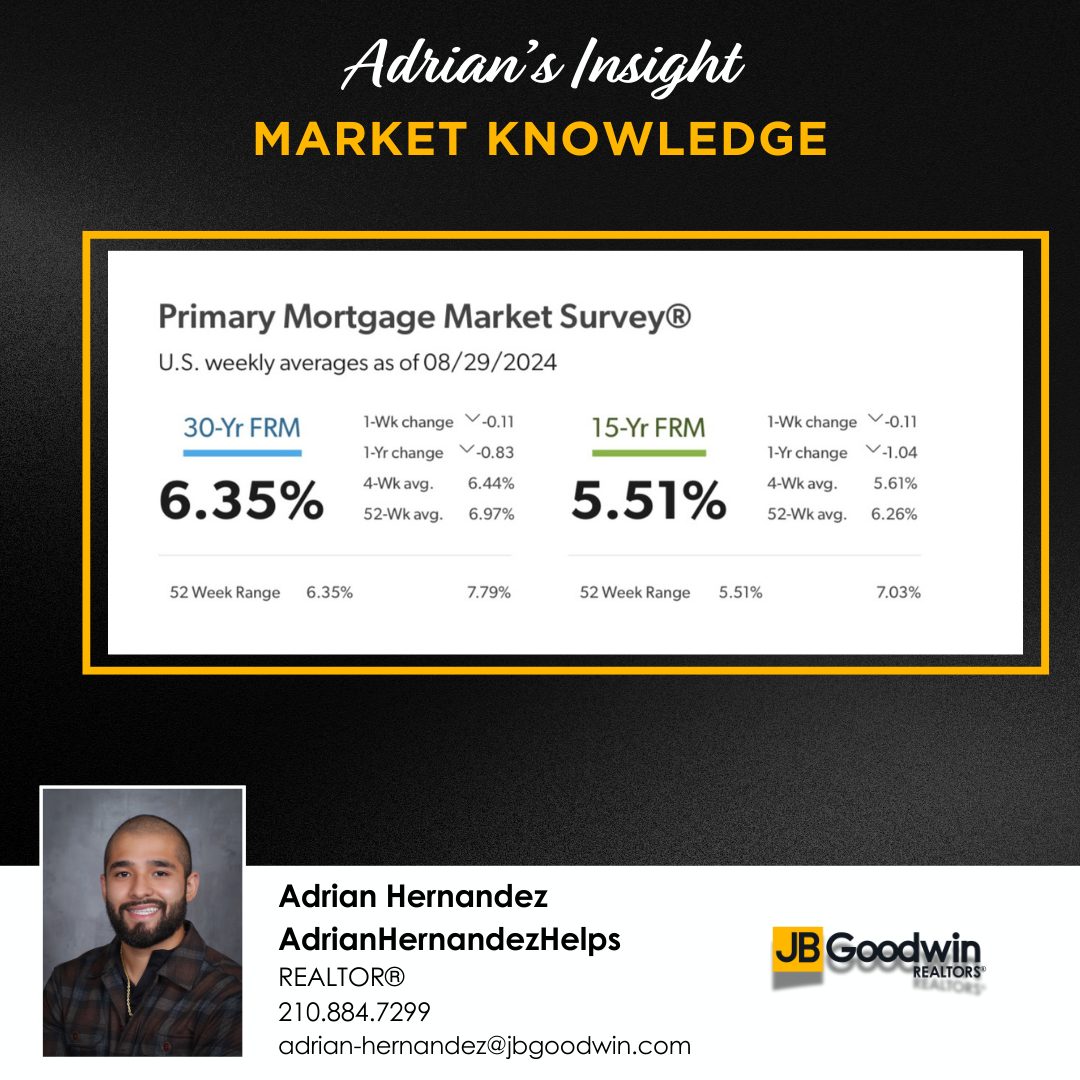

As geopolitical tensions grow and various other factors apply market pressure, we have seen the trend of declining mortgage rates come to a possible halt. This could be alarming; however, buyers should rest assured that rates have not risen to previous positions.

AdrianHernandezHelps-JBGoodwin REALTORS®

📞(210)884-7299

📧adrian-hernandez@jbgoodwin.com

Have an awesome day!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link